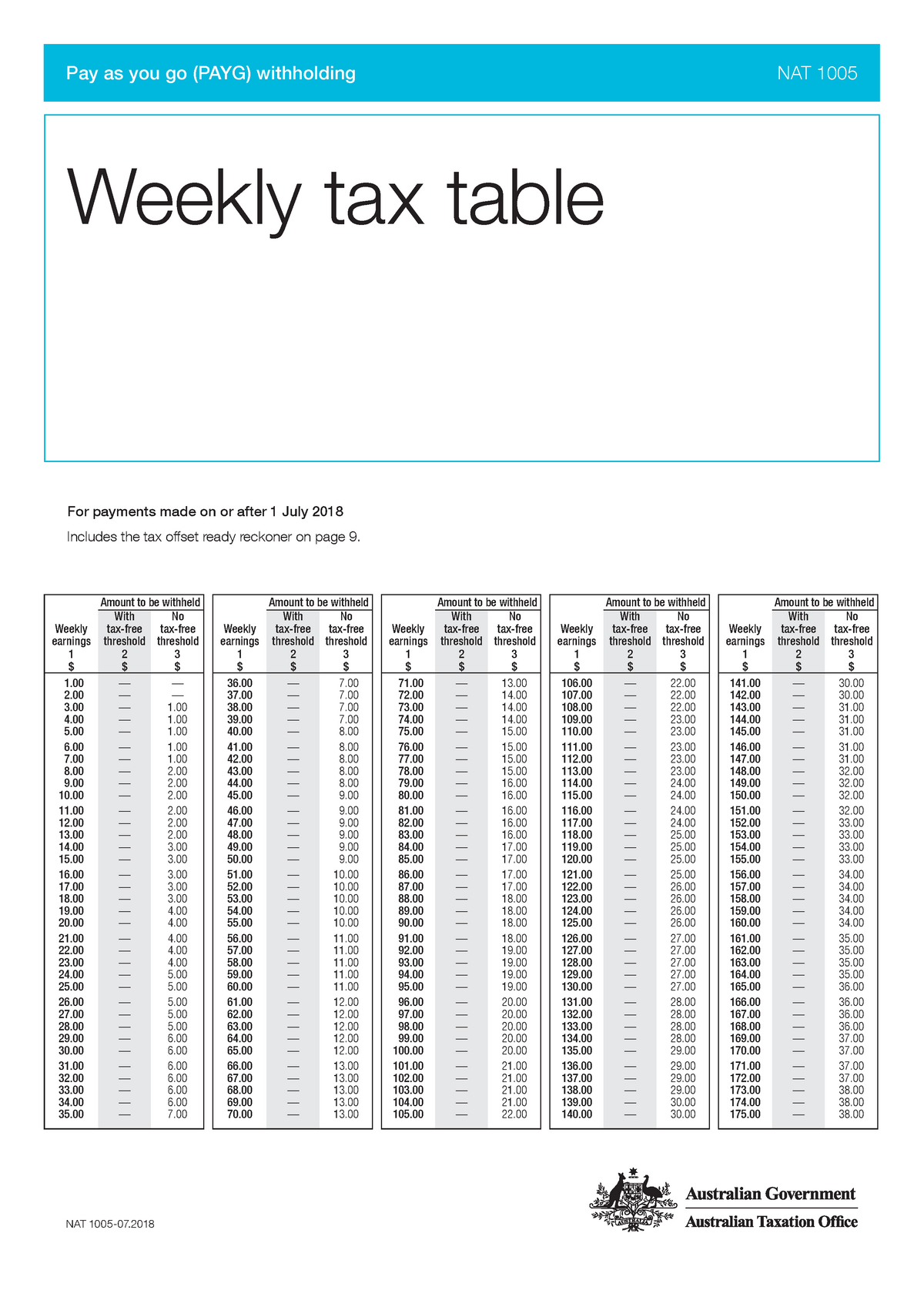

Weekly Tax Table 2025. Find out what changed and how to. If you're an employer or another withholding payer, our tax withheld calculator can help you work out the tax you need to withhold from payments you make to employees and other.

If you’re an employer or another withholding payer, our tax withheld calculator can help you work out the tax you need to withhold from payments you make to employees and other. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax.

Weekly Tax Table Federal Withholding Tables 2025, The current tax year is from 6 april 2025 to 5 april 2025. £184.03 or 90% of the employee’s average weekly earnings, whichever is lower:

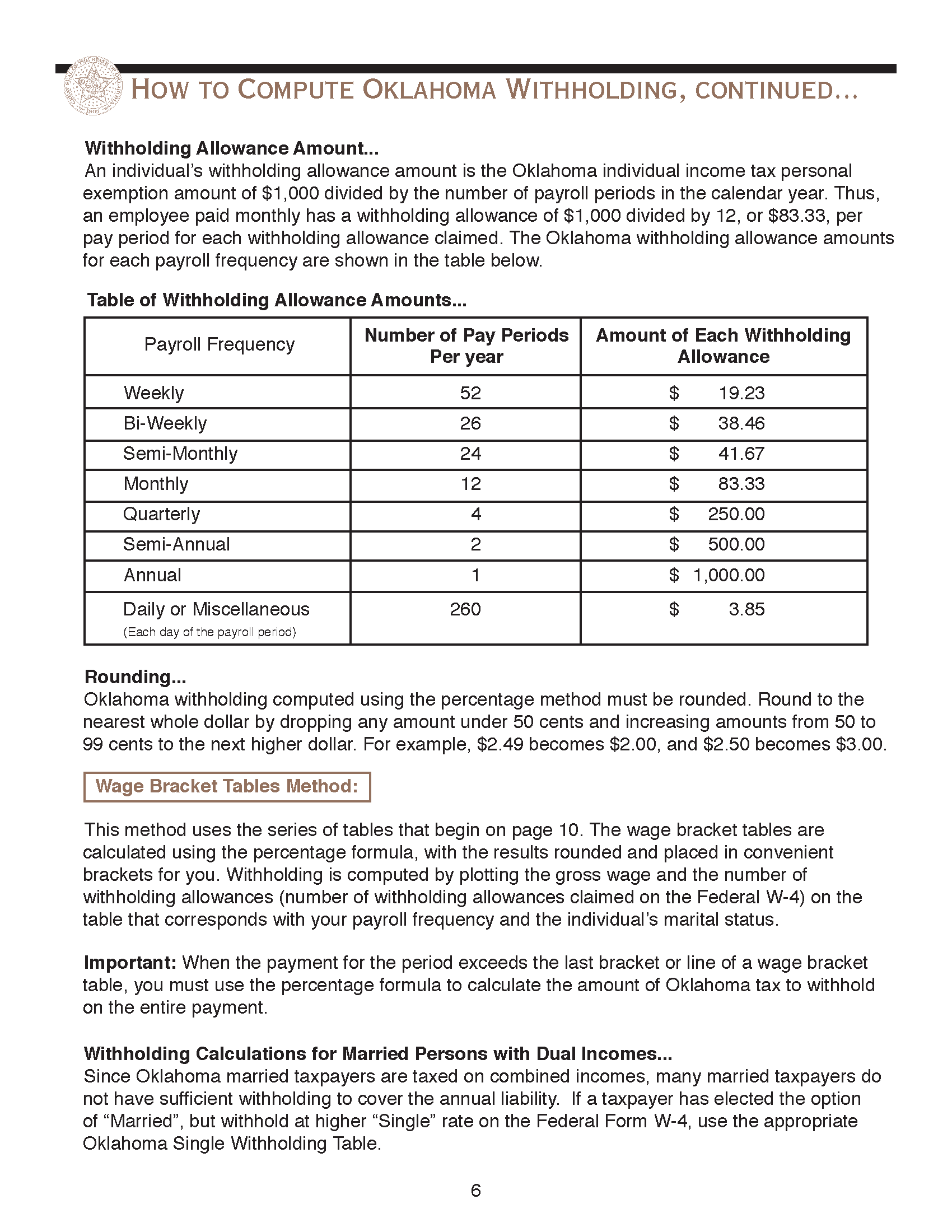

BiWeekly Federal Tax Withholding 2025 Federal Withholding, Learn how to use the federal withholding tax tables for 2025 with quickbooks' simple guide. Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax.

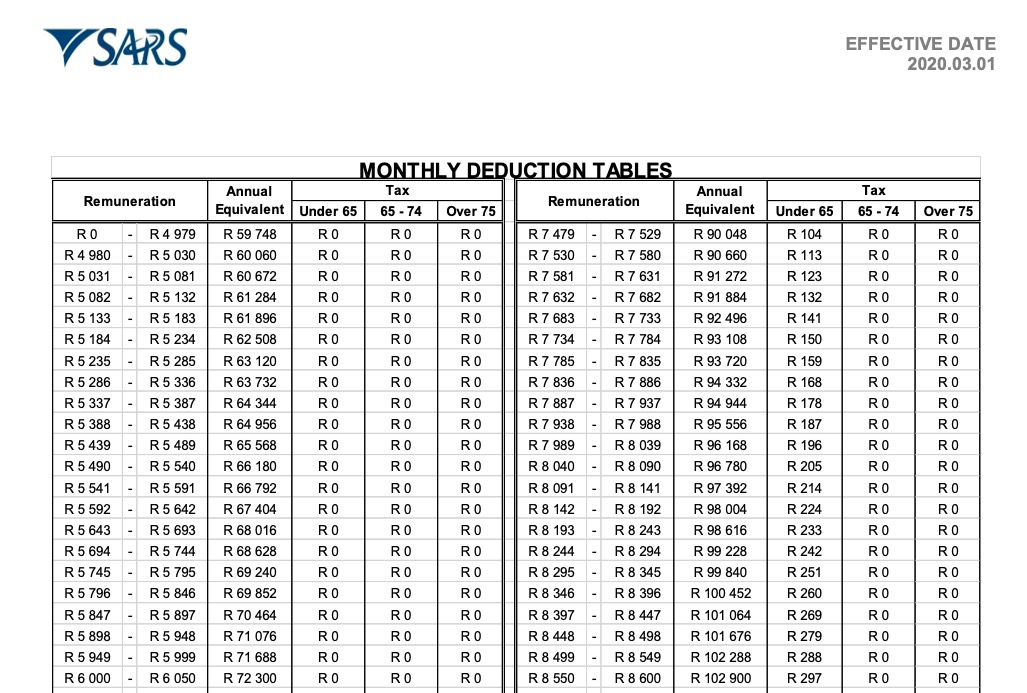

Weekly tax table 2018 19 NAT 1005 Pay as you go (PAYG) withholding, 2025 income tax withholding tables. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

How Many Days Until May 7 2025 Federal Tax Return Ryann Claudine, £184.03 or 90% of the employee’s average weekly earnings, whichever is lower: Page last reviewed or updated:

Federal BiWeekly Tax Table Federal Withholding Tables 2025, £184.03 or 90% of the employee’s average weekly earnings, whichever is lower: The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

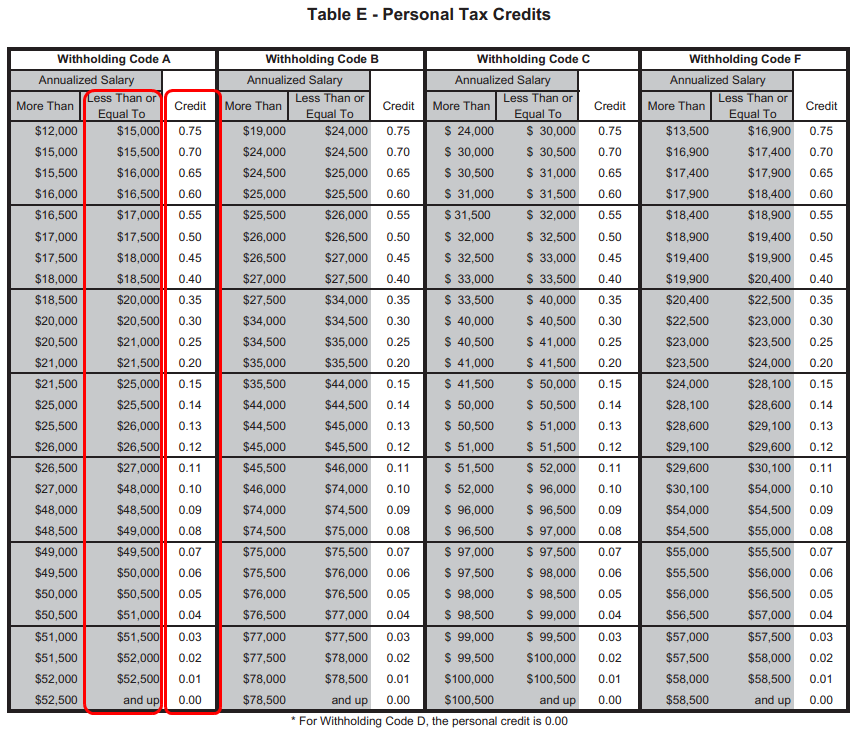

Connecticut State Tax Withholding Form 2025, Find out what changed and how to. See current federal tax brackets and rates based on your income and filing status.

Fed Employer Withholding Tax Chart Hot Sex Picture, 2025 income tax withholding tables. Page last reviewed or updated:

How to Calculate Payroll Taxes for Your Small Business, Enter your weekly salary, filing status and select a state for instant federal and state tax deductions for 2025 The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Married Federal Tax Withholding Table Federal Withholding Tables 2025, Find out what changed and how to. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

2025 Top Tax Rate Dasha Emmalee, For reference, the top federal income tax rate is 37%, and the bottom rate is 10%. Ato produces a range of tax tables to help employers work out how much to withhold from payments they make to their employees or other payees.

DIY Tutorials WordPress Theme By WP Elemento